In the rapidly evolving business landscape of Saudi Arabia, where Vision 2030 pushes digital transformation to the forefront, companies must adopt smarter financial processes to stay competitive. Among the most impactful of these processes is the automation of recurring payments.

Recurring payments simplify operations, enhance cash flow predictability, and significantly improve customer satisfaction. However, achieving seamless automation requires a robust, secure, and flexible payment solution tailored to the unique needs of Saudi businesses.

This is where Spider Pay, an innovative product from Spider Web, steps in. Designed specifically for the local market, Spider Pay empowers businesses of all sizes to automate recurring payments effortlessly, ensuring secure, efficient, and compliant transactions. In this article, we will explore everything business leaders need to know about recurring payments and how Spider Pay can transform their financial operations.

What Are Recurring Payments?

Recurring payments refer to automatic transactions where customers authorize businesses to deduct money from their accounts at regular intervals for ongoing services or subscriptions. These payments can be fixed, such as a monthly subscription fee, or variable, like utility bills that fluctuate based on usage.

Several sectors in Saudi Arabia are increasingly leveraging recurring billing models:

- E-commerce platforms offering subscription boxes.

- Healthcare providers managing monthly insurance or membership fees.

- Educational institutions handling tuition in installments.

- Software as a Service (SaaS) companies renewing software licenses.

The recurring payments model not only streamlines revenue collection but also enhances customer loyalty by removing friction from the payment process.

Why Automate Recurring Payments?

The benefits of automating recurring payments go far beyond convenience. Here’s why forward-thinking Saudi businesses are prioritizing automation:

- Steady Cash Flow: Predictable revenue inflow allows for better financial planning and resource allocation.

- Higher Customer Retention: Automated billing reduces churn caused by missed or forgotten payments.

- Reduced Administrative Burden: Manual invoicing and payment tracking become obsolete, freeing up valuable human resources.

- Minimized Errors: Automation decreases the risk of human errors that could lead to financial discrepancies.

- Regulatory Compliance: Automated systems ensure consistent application of tax regulations, which is critical in the Saudi business environment.

In a market where efficiency and customer satisfaction are paramount, businesses that automate recurring payments position themselves for sustainable growth.

Common Challenges in Managing Recurring Payments Manually

Despite the advantages, many businesses still struggle with manual management of recurring payments, facing issues such as:

- Missed or Late Payments: Human error and oversight often result in delayed revenues.

- Complex Invoicing Processes: Custom billing cycles and amounts can make manual tracking overwhelming.

- Higher Operational Costs: Dedicated teams are often needed to manage billing manually.

- Customer Dissatisfaction: Errors or inconsistencies can lead to disputes and a tarnished brand image.

Manual management is not only inefficient but can significantly hinder a business’s scalability and customer trust. To thrive, Saudi businesses must embrace digital solutions like Spider Pay.

Introducing Spider Pay: A Complete Digital Payment Ecosystem

Spider Pay by Spider Web is a cutting-edge payment platform designed specifically to meet the evolving needs of businesses in Saudi Arabia. It offers a fully integrated suite of services:

- Payment Gateway: Seamlessly accept online payments with full security and local compliance.

- Pay By Link: Generate and send secure payment links for easy customer transactions.

- Soft POS: Accept payments on smart devices without the need for traditional point-of-sale hardware.

- Recurring Payments: Automate subscription billing and ongoing service fees effortlessly.

- Electronic Invoicing (Spider Scan & Go): Issue compliant e-invoices with QR codes for faster processing.

Spider Pay combines versatility, speed, and security, making it the ideal choice for businesses aiming to streamline their financial operations and deliver exceptional customer experiences.

How Spider Pay Simplifies Recurring Payments

Easy Setup and Configuration

One of Spider Pay’s standout features is its simplicity. Businesses can integrate Spider Pay into their existing platforms effortlessly through a secure API. For non-technical teams, Spider Web provides comprehensive onboarding support, ensuring a smooth and quick setup.

Setting up recurring billing is straightforward: choose the billing cycle (weekly, monthly, quarterly, annually), input customer information, and the system manages the rest automatically.

Flexible Payment Options

Flexibility is crucial for the Saudi market, and Spider Pay excels in this area. It supports a wide range of payment methods including:

- Mada (the dominant local payment network)

- Credit and Debit Cards

- STC Pay

- Apple Pay

This wide array of payment options ensures customers can pay using their preferred method, improving satisfaction and loyalty.

Businesses can also customize billing cycles to fit their unique needs — whether offering daily newspaper subscriptions or annual healthcare plans.

Seamless Customer Experience

Customer experience is at the heart of Spider Pay’s design. Once subscribed, customers receive automated billing notifications, payment confirmations, and reminders, all without manual intervention from your staff.

Transactions are processed swiftly and securely, backed by state-of-the-art encryption and compliance with local cybersecurity regulations, fostering trust with your clientele.

Real-Time Monitoring and Reporting

Spider Pay’s dynamic dashboards offer real-time visibility into payment activities. Business owners and finance teams can track:

- Payment statuses (successful, pending, failed)

- Customer subscription histories

- Revenue analytics

- Outstanding invoices

Armed with these insights, businesses can make informed decisions to optimize cash flow and customer engagement strategies.

Saudi Market Compliance

Operating in Saudi Arabia means strict adherence to regulatory frameworks, including ZATCA’s e-invoicing mandates. Spider Pay ensures:

- Full Arabic language support.

- ZATCA-compliant electronic invoicing.

- Secure storage and encryption of sensitive data.

- Ongoing updates to stay aligned with regulatory changes.

This level of compliance protection is critical for businesses aiming to avoid penalties and safeguard their reputation.

Real-World Applications of Recurring Payments with Spider Pay

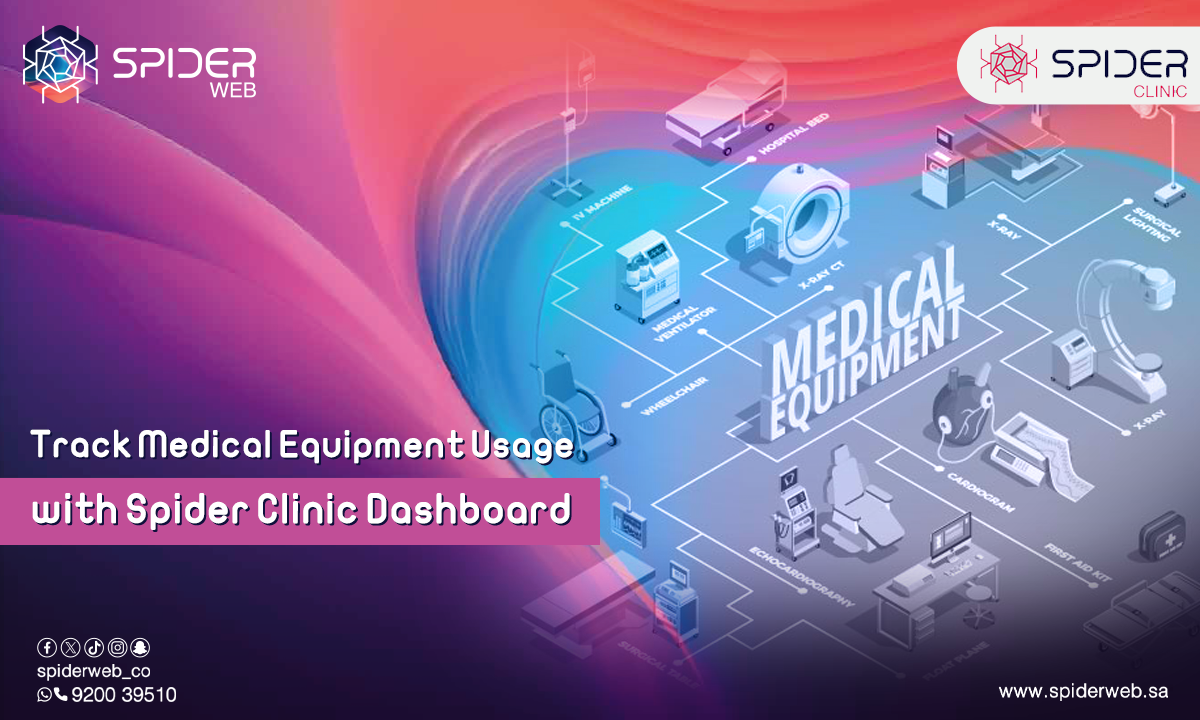

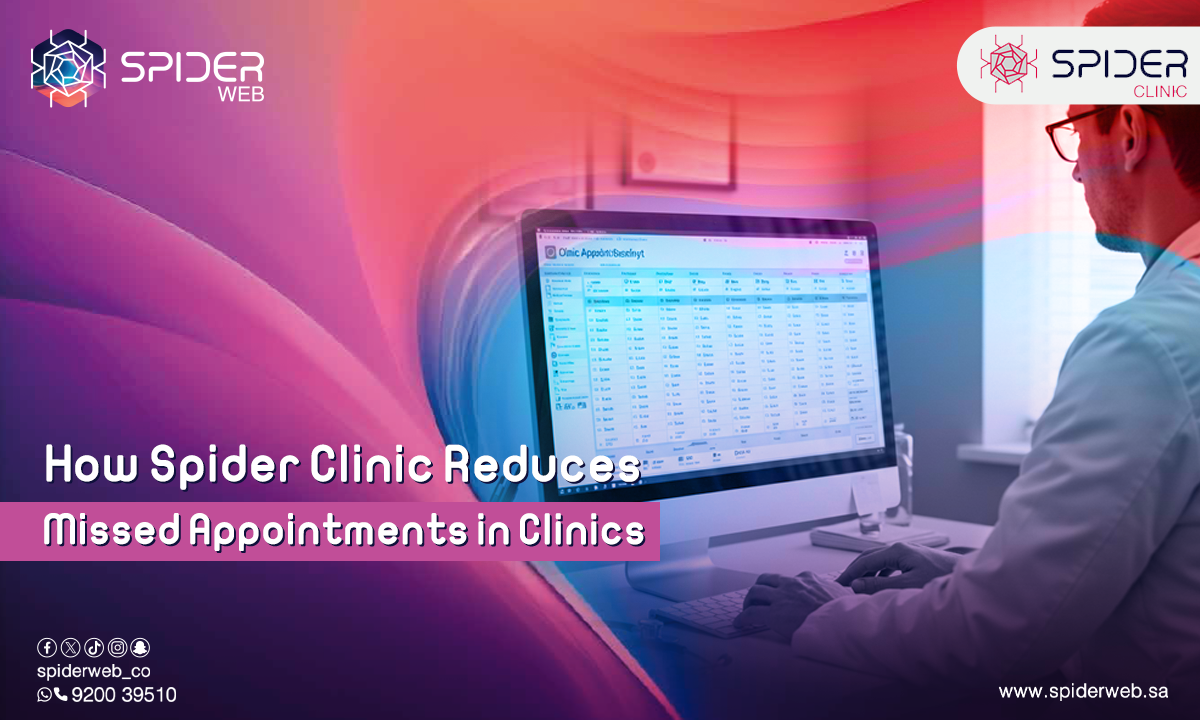

Healthcare Sector

Private clinics and medical centers can use Spider Pay to automate monthly membership fees, insurance co-payments, and treatment installment plans. Patients benefit from seamless payments, while providers enjoy predictable cash flow.

E-Commerce Businesses

Subscription-based models such as monthly beauty boxes, meal kits, or fashion rentals thrive with Spider Pay. Customers enroll once, and businesses enjoy steady revenues with minimal administrative overhead.

SaaS Companies

Software providers offering monthly or yearly licenses can automate renewals, reduce churn, and increase user lifetime value, ensuring consistent growth.

Educational Institutions

Schools, universities, and training centers can manage tuition fees more efficiently by offering parents flexible installment plans via Spider Pay, with automated reminders and receipts.

Each of these sectors illustrates how Spider Pay not only streamlines payments but also elevates the overall customer experience.

Why Choose Spider Pay for Recurring Billing?

- Local Expertise: Developed by Spider Web, a Saudi company with deep knowledge of local business dynamics and regulatory environments.

- Comprehensive Solution: Beyond recurring payments, Spider Pay integrates full-service e-commerce and in-person payment capabilities.

- Scalable and Customizable: Whether you are a startup or a large enterprise, Spider Pay adapts to your specific needs.

- 24/7 Arabic and English Support: Spider Web’s dedicated team provides around-the-clock assistance, ensuring business continuity.

- Top-Grade Security: Spider Pay utilizes advanced encryption and security protocols to protect customer and business data.

- Seamless Integrations: Easily connect Spider Pay to your existing ERP, CRM, or custom systems using powerful APIs.

Choosing Spider Pay means choosing a partner committed to empowering Saudi businesses in their digital transformation journey.

Best Practices for Maximizing Recurring Payments Success

To fully leverage recurring payments through Spider Pay, consider these best practices:

- Offer Multiple Payment Methods: Cater to customer preferences by accepting Mada, STC Pay, and more.

- Be Transparent: Clearly communicate subscription terms, cancellation policies, and billing dates to avoid misunderstandings.

- Automate Customer Communication: Use automated reminders, confirmations, and invoices to maintain engagement and trust.

- Monitor Performance: Regularly review KPIs like customer churn rates, payment success rates, and revenue growth to identify areas for improvement.

Implementing these practices not only improves operational efficiency but also strengthens customer loyalty and long-term profitability.

Conclusion

Recurring payments are not just a trend — they are the future of business transactions in Saudi Arabia. By automating this critical function, companies unlock greater operational efficiency, enhance customer satisfaction, and secure predictable revenue streams.

Spider Pay by Spider Web offers Saudi businesses an unparalleled solution for automating recurring payments. With its robust features, local compliance, easy integration, and focus on customer experience, Spider Pay stands out as the definitive choice for businesses ready to embrace digital transformation.

Don’t let manual processes hold your business back. Empower your operations with Spider Pay today and position your company at the forefront of Saudi Arabia’s digital economy.

To discover how Spider Pay can revolutionize your payment processes, visit Spider Pay or contact the Spider Web team for a personalized consultation and demo. Transform your payment operations and drive your business growth with the trusted Saudi experts in digital solutions.